Roivant Sciences Inc., an umbrella for five biopharma companies and a new tech-focused venture, has secured biopharma's biggest-ever private financing, a $1.1 billion equity investment led by Softbank Vision Fund. The investment is expected to accelerate its launch of new subsidiaries within and beyond drug development, starting with the newco Datavant. CEO Vivek Ramaswamy told BioWorld that the new venture aspires to apply artificial intelligence and machine learning to "shelved data sets" in hopes of yielding insights that can speed drug development.

Roivant Sciences Inc., an umbrella for five biopharma companies and a new tech-focused venture, has secured biopharma's biggest-ever private financing, a $1.1 billion equity investment led by Softbank Vision Fund. The investment is expected to accelerate its launch of new subsidiaries within and beyond drug development, starting with the newco Datavant. CEO Vivek Ramaswamy told BioWorld that the new venture aspires to apply artificial intelligence and machine learning to "shelved data sets" in hopes of yielding insights that can speed drug development.

Basel, Switzerland-based Roivant's mission, as Ramaswamy frames it, is to solve structural problems across biopharma and, eventually, across health care more generally. To date, the company's work on that mission has focused it on finding and reviving promising drug candidates stuck in what he calls "R&D traffic jams," stalls due to corporate, strategic or financial constraints.

The 14 drugs it has secured so far form the core assets of five separate operating companies headlined by two high-profile public players: Alzheimer's-targeting Axovant Sciences Ltd. and the women's health and prostate cancer drug developer, Myovant Sciences Ltd. Axovant shares (NYSE:AXON) fell about 2 percent to $22.58 on Wednesday, while Myovant shares (NYSE:MYOV) fell almost 9 percent to $10.39.

It has also formed three private companies: Dermavant Sciences Ltd. to work on dermatology drugs, Enzyvant Sciences Ltd. for rare diseases, and Urovant Sciences Ltd. for urology indications.

More 'Vants,' more breadth

Though separate, each Roivant company relies on the mothership for core services, such as non-clinical development, clinical pharmacology. With new 'Vants' planned in new disease areas, Ramaswamy said it will need to make new investments in that central supportive infrastructure. Adjacent, though separately, he said, Roivant is raising the curtain on a new area: a platform dedicated to making improvements in the pharmaceutical development process itself.

Enter Datavant, which he said is "dedicated to solving a structural problem of a different kind, here not a shelved drug, but, effectively of shelved data sets that don't have full value extracted from them because they're siloed from other data sets." Access to patient level data sets in a particular indication of interest, for instance, might help drive more intelligent trial design, reduce trial costs, and even improve odds for success, he said.

Softbank's Vision Fund combines money from both Softbank Group Corp., the Public Investment Fund of the Kingdom of Saudi Arabia, Apple Inc., and others. It had drawn together $93 billion of committed capital at its first major closing in May. With that money, it has made significant investments across numerous sectors,

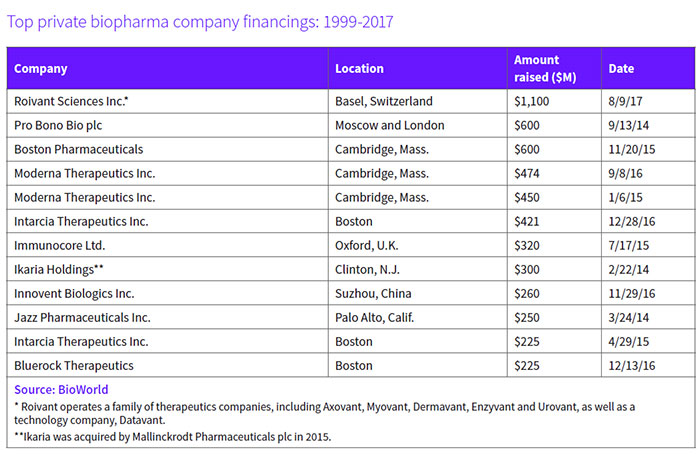

In light of Roivant's status as the parent of multiple companies, the the fund's whopper investment isn't wholly comparable to other private financings in the sector. On a single company basis, Rusnano-backed Pro Bono Bio plc and Boston Pharmaceuticals are co-record holders, each having landed $600 million in private investment. Moderna Therapeutics Inc. and Intarcia Therapeutics Inc. round out the top five spots with sizable raises of their own. (See the chart below: Top private biopharma company financings: 1999-2017.)

But even when divided to fulfill a multitude of purposes, the new funds are arriving at an opportune time for Roivant, just as numerous big pharma companies are paring and reshaping their portfolios, selling what could be the seeds of the next 'Vant.