After spinning its wheels for a couple of months, the biopharmaceutical sector looks poised for a welcomed surge. Stocks of the leading companies by market cap pushed higher last week, catalyzed by solid first-quarter returns from those that released their financials. That bodes well for those that are scheduled to report this week, and if companies continue to demonstrate strong opening quarter results this could encourage investors back to the sector once again and trigger an extended bullish period.

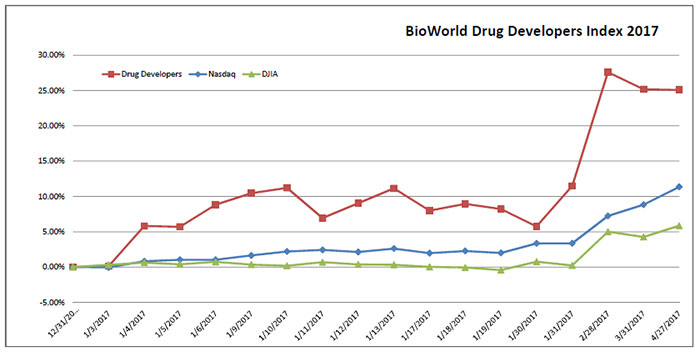

The BioWorld Biopharmaceutical Index held steady in April despite the ups and downs of the general markets, with investors trying to figure out the consequences that President Donald Trump's impending proposed tax reforms would have on market direction. As it turned out, the markets ended on a high note generated by solid corporate earnings across all sectors. Technology was certainly in favor, with the Nasdaq Composite index hitting a new high rising above 6,000 for the first time. With one more trading day left before month end, the Dow Jones Industrial average closed up 1.5 percent and the Nasdaq recorded a 2 percent growth in value in the same period. (See BioWorld Biopharmaceutical Index, below.)

Setting the tone

Setting the tone for biopharma's earnings season was Biogen Inc., whose shares (NASDAQ:BIIB) jumped about 3.6 percent in one day as investors responded positively to the company's strong EPS and revenue returns in the first quarter.

It was just the start the sector needed and also for Biogen. On a conference call to discuss the results, company CEO Michel Vounatsos noted, "Q1 was a very good quarter financially and also a quarter with exciting events."

Biogen generated revenues of $2.8 billion, a 3 percent increase from the same period a year ago. What got the Street excited was the successful market launch of spinal muscular atrophy drug Spinraza (nusinersen), which generated revenues of $47 million in the first quarter, well ahead of the consensus forecast of $16 million. The antisense oligonucleotide, developed by Carlsbad, Calif.-based Ionis Pharmaceuticals Inc., was approved late last year. (See BioWorld Today, Dec. 28, 2016, and April 26, 2017.)

Vounatsos also highlighted the company's solid multiple sclerosis (MS) franchise in the quarter, with both Tysabri (natalizumab) and Tecfidera (dimethyl fumarate) enjoying a 38 percent global market share and MS revenues growing 3 percent.

The company is tightly focused on neuroscience and expects "this to remain our core moving forward," he said. "We intend to maximize the potential of our R&D assets and bolster our pipeline through both internal and external opportunities."

Biogen's shares at $276.67 were up 1.2 percent for the month.

Looking for opportunities

It has been a quiet period for biopharma M&A, particularly in April, which is why analysts and investors have been listening closely to what, if anything, reporting companies are saying about their plans for dealmaking going forward. It is no secret that the sector's blue chip companies are sitting on a mountain of cash. Amgen Inc., for example, reported it had about $38 billion in cash and investments. The fact that its first-quarter financials were somewhat disappointing might spur the company to pull the trigger on a deal in the not-too-distant future.

The Thousand Oaks, Calif.-based company reported that its total revenues decreased 1 percent vs. the first quarter of 2016 to $5.46 billion and missed analyst estimates of $5.61 billion. GAAP net income totaled $2.07 billion and GAAP earnings per share (EPS) totaled $2.79. Non-GAAP EPS was $3.15, however, which beat analyst estimates of $3 per share.

Despite the bottom-line beat, J.P. Morgan analyst Cory Kasimov in a research note commented that "weakness from key products – including Enbrel and Repatha – are cause for concern."

The company said sales of Enbrel (etanercept) dropped 15 percent to $1.18 billion, with competition and lower rheumatology and dermatology segment growth compared to prior quarters having a major impact. Its anti-PCSK9 drug Repatha (evolocumab) only generated sales of $49 million in the quarter.

Shares of Amgen (NASDAQ:AMGN) were trading down 0.8 percent for the month.

The sector's second largest company by market cap, Celgene Corp., in its first-quarter financials, also beat bottom-line estimates but came up light on its top-line. The company reported net product sales of $2.95 billion for the first quarter, up 18 percent from the same period in 2016, although total revenue of $2.96 billion missed analyst estimates of $3.04 billion. GAAP net income was $941 million, or $1.16 per share. Non-GAAP earnings per share of $1.68, however, came in higher than consensus estimates of $1.63 per share.

Sales of Revlimid (lenalidomide) reached $1.8 billion during the first quarter, which were generally in-line with estimates. Analysts, however, focused in on sales of its oral phosphodieasterase-4 (PDE4) inhibitor, Otezla (apremilast), for adults with active psoriatic arthritis, which reached $242 million, a $100 million miss on consensus due in part to what the company cited as market contractions in the U.S.

As of March 31, the company had about $8.9 billion in cash, equivalents and marketable securities. Its shares (NASDAQ:CELG) closed Thursday at $123.97, down slightly for the month at 0.4 percent.

Helping support the positive mood for the sector was Boston-based Vertex Pharmaceuticals Inc., whose Q1 financial results, which were released after market close on Thursday, beat both the top- and bottom-line estimates.

The company continues to expand its cystic fibrosis (CF) franchise and its total CF product revenues came in at $480.6 million compared to $393.6 million for the first quarter of 2016. Specifically, net product revenues from Orkambi (lumacaftor/ivacaftor) were $294.9 million compared to $223.1 million for the first quarter of 2016; net product revenues from Kalydeco (ivacaftor) were $185.7 million, compared to $170.5 million for the first quarter of 2016.

GAAP net income was $247.8 million, or 99 cents per diluted share, compared to a net loss of $41.6 million, or 17 cents per diluted share, for the first quarter of 2016. In the first quarter, the company recorded up-front revenue from the out-licensing of four oncology programs to Merck KGaA, of Darmstadt, Germany. Non-GAAP net income was $101.4 million, or 41 cents per diluted share, compared to $22.4 million, or 9 cents per diluted share, for the first quarter of 2016. As of March 31, the company had $1.4 billion in cash, cash equivalents and marketable securities, which according to Vertex's chairman, president and CEO, Jeffrey Leiden, gives "more firepower to go out and acquire other programs and assets to complement our internal portfolio."

Shares of Vertex (NASDAQ:VRTX) closed up 7.2 percent for the month.

Cambridge, Mass.-based Sarepta Therapeutics Inc. did not spoil the mood with its "beat and raise" financial results for the first quarter of 2017, which were also reported late Thursday.

The company recognized net revenues of $16.3 million in sales of its Duchenne muscular dystrophy drug, Exondys 51 (eteplirsen), topping both consensus estimates of $13.8 million and guidance of $13 million to $15 million. It also noted that due to continued patient and physician interest in the drug, coupled with progress in the reimbursement landscape, it anticipates that net revenues for the year will exceed $95 million.

Sarepta reported GAAP net income of $84.1 million, or $1.50 per diluted share, compared to a net loss of $59.8 million for the same period of 2016, or $1.31 per diluted share. The increase in income the company attributed to the gain on sale of its rare pediatric disease priority review voucher and sales of Exondys 51. Non-GAAP net loss for the first quarter of 2017 was $33 million, or 60 cents per share, compared to a non-GAAP net loss of $52.5 million for the same period of 2016, or $1.15 per share.

The company reported it had $391.1 million in cash, cash equivalents and investments as of March 31, and its share value (NASDAQ:SRPT) was up 17 percent in April.

By the numbers

The BioWorld Drug Developers Index (below) was unchanged in April and for the year remained up 25 percent.

The collective market cap of the 363 public biopharmaceutical companies tracked by BioWorld was $805 billion, a 2.5 percent increase over the total at the end of March.