The leading biopharmaceutical companies had no difficulty getting into the spirit of Halloween by posting some particularly scary performances on the stock market in October. The BioWorld Biopharmaceutical index fell a dramatic 10 percent, and it now sits underwater by 22 percent year to date with little chance of getting back to even before the end of 2016.

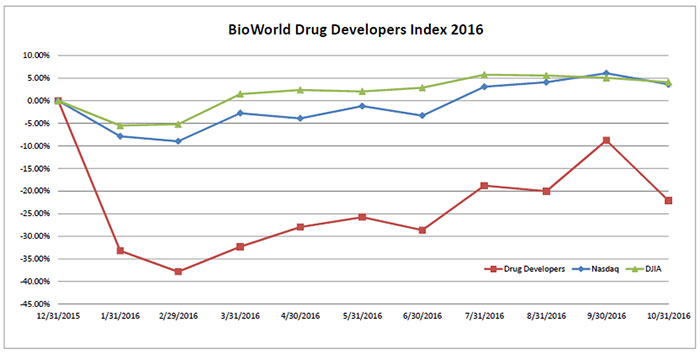

While the general markets haven't had a stellar year either, the Dow Jones Industrial Average and the Nasdaq Composite index are, in comparison, both up 4 percent so far despite a 1 percent and 2 percent respective dip in October. (See BioWorld Biopharmaceutical Index 2016, below.)

It is not difficult to identify the root cause of the market malaise – the impending U.S. presidential election. This week the nation will finally breathe a collective sigh of relief following the conclusion of a very long and often vitriolic campaign waged by Hillary Clinton and Donald Trump. The calm will be short-lived, however, because, depending on the outcome, there will be an immediate significant impact on the markets and the health care sector in particular.

Uncertainties about the pricing of medicines have served to keep the valuations of biotech companies depressed all year long.

That may change if the scenario of a Clinton win but divided Congress plays out. The sentiment is that there will be a post-election recovery in the fortunes of biopharma similar to other election cycles.

Back in 2012, biopharma had a similar dip in value heading into the election period but then recovered and closed out the year up a significant 34 percent. (See BioWorld Biopharmaceutical Index 2012, below.)

As we know now, that was the beginning of biotech's great run that peaked in January of this year. Biotech executives will be hoping for a similar outcome once the election dust settles. But analysts are predicting that we shouldn't hold out too much hope that this will happen anytime soon.

Negative sentiment

According to a Cowen & Co.'s Biotech Thermometer report, it indicates that their clients "increasingly believe there is no quick fix, that biotech fundamentals are at risk, and that the environment may need to get worse before it gets better."

That negative sentiment remains firmly ingrained despite respectable third-quarter financial results posted by biopharma companies.

Thousand Oaks, Calif.-based Amgen Inc. recorded a net income of about $2.02 billion, up 8 percent from net income of $1.86 billion during the third quarter of last year. Total product sales, however, were flat for the third quarter of 2016 as compared to last year, it said, evidenced by quarterly Enbrel (etanercept) sales of $1.45 billion vs. $1.46 billion during the third quarter of 2015. Management attributed the standstill to a higher net selling price offset by the impact of competition and unfavorable changes in inventory levels.

The company reported above consensus Q3 revenues of $5.81 billion and non-GAAP EPS of $3.02. Cowen and Co. analyst Eric Schmidt noted that while Amgen will likely exceed expectations again in the final quarter of this year, "the outlook for Enbrel pricing has changed, placing added pressure on the company's pipeline to deliver in 2017."

By the end of October, Amgen's share value (NASDAQ:AMGN) closed at $141.16, down 15.3 percent, and by last Thursday had fallen even further to $135.22, bringing its market cap down to $101 billion and in danger of losing its $100 billion club membership. Gilead Sciences Inc. – the other exclusive club member in the category – lost its membership earlier this month and its market cap now stands at $94 billion following a 7 percent drop in its share price (NASDAQ:GILD) in October. Overall, the Foster City, Calif.-based company has had a year it will want to forget, seeing its share value drop a whopping 27 percent year to date.

The company did report total product sales of $7.4 billion for the third quarter, and its revenues were $7.5 billion coming in slightly ahead of consensus estimates; but that failed to impress investors. They believe that with more than $31 billion in the bank, as of Sept. 30, the company should be boosting its pipeline assets through a major acquisition. Like previous earnings calls this year, company CEO John Milligan reiterated that the firm will not be rushed into a deal and execs are "going to remain disciplined, and we're going to keep the bar high." (See BioWorld Today, Nov. 3, 2016.)

With biopharma company valuations continuing to fall it would seem that the time would be ripe for the company to deploy some of its cash. And most analysts hold that view, with J.P. Morgan analyst Cory Kasimov not expecting the company's industry-low multiple (6.3x vs. biotech at 12.5x, U.S. pharma at 15.8x) to meaningfully change absent new growth drivers such as a major deal. "Fortunately, Gilead's balance sheet is exceptionally strong; hopefully they find something to do with it," he wrote.

Regeneron Pharmaceuticals Inc. is another company in the group that will want to see the back of 2016, with its share value tumbling a whopping 36 percent year to date. Not helping its cause in the eyes of investors was a report that, just ahead of the PDUFA date assigned to sarilumab, Regeneron, along with partner and Sanofi SA, received a complete response letter (CRL) regarding the BLA for the interleukin-6 antibody to treat adults with moderate to severe rheumatoid arthritis. (See BioWorld Today, Oct. 31, 2016.)

The CRL cites certain deficiencies identified during a routine good manufacturing practice inspection of the Sanofi Le Trait facility in France where sarilumab is filled and finished. Regeneron said Sanofi is working closely with the FDA "towards a timely resolution that addresses these concerns. The CRL does not identify any concerns relating to the safety or efficacy of sarilumab."

Last Friday, Regeneron released its third-quarter financial results, which revealed that its flagship product, Eylea (aflibercept) injection, generated U.S. net sales of $854 million, an increase of 16 percent over the third quarter 2015 revenue and in line with expectations. Whether that, together with the progress that the company is making with its deep pipeline of 16 product candidates in clinical development, will be enough to reverse its fortunes remains to be seen.

Celgene Corp., despite beating consensus, posting third-quarter earnings per share of $1.58, 10 cents higher than estimates, ended October with its share value (NASDAQ:CELG) down 2.2 percent. Third-quarter revenue reached $2.98 billion, up 28 percent over the same period in 2015. Sales of Revlimid (lenalidomide) totaled $1.89 billion, a 30 percent increase year over year, driven by new patient market share gains and increased duration, the company said. U.S. sales totaled $1.15 billion, with the remaining $738 million coming from international sales. The company ended the quarter with about $6.9 billion in cash, equivalents and marketable securities.

The only company in the Biopharmaceutical index group to see its shares close October in positive territory was Alexion Pharmaceuticals Inc., which closed (NASDAQ:ALXN) at $130.50, a gain of $9.96, or 6.50 percent. The New Haven, Conn.-based firm returned consensus-beating top- and-bottom line estimates for the third quarter. (See BioWorld Today, Oct. 28, 2016.)

The company posted total revenues of $799 million for the three months ending Sept. 30, a 20 percent jump over the same period in 2015. Boosting product sales was Soliris (eculizumab), the company's flagship orphan product for paroxysmal nocturnal hemoglobinuria and atypical hemolytic uremic syndrome, with net sales of $729 million. Alexion is looking to expand the drug's label to include myasthenia gravis.

Drug developers head south

The BioWorld Drug Developers index had a complete reversal in fortunes in October with its value dropping almost 15 percent. The flight of investors in the wake of the pending election was clearly at work, with most companies in the group seeing their share drop dramatically. (See BioWorld Drug Developers Index, below.)

Leading the decliners in the group is Alnylam Pharmaceuticals Inc., whose shares (NASDAQ:ALNY) closed October down almost 48 percent, mainly due to the company halting phase III development of RNAi drug revusiran for hereditary transthyretin amyloidosis with cardiomyopathy because of reported trial deaths. (See BioWorld Today, Oct. 7, 2016.)

The only bright spot among a sea of red numbers was Tesaro Inc., whose shares (NASDAQ:TSRO) climbed 21 percent in October. That performance was driven by the release of full results of its phase III NOVA trial presented at the European Society for Medical Oncology meeting showing that the once-daily PARP inhibitor niraparib significantly extended the time during which women with recurrent ovarian cancer were able to live with their disease before their tumors began to grow again. (See BioWorld Today, Oct 11, 2016.)

Bears WIDE AWAKE

Regardless of who wins the election, it looks as though the biopharma sector will limp into 2017 battered and bruised with biotech executives hoping for better times ahead. Will they get their wish and will history repeat itself with a reversal in the sector's fortunes similar to what transpired post-election in 2012?

While that could happen, as several election cycles have proved, it is highly unlikely this time around. Evidence includes the third-quarter financial results, which haven't done much to help lift the gloom that hangs over the sector. Also, biotech innovation, which had been the darling among investors for the past four years, in the minds of politicos, payers and patients currently at least, doesn't equate to value, which makes the pricing of novel medicines a veritable minefield for companies to navigate.

To reverse that perception the industry has to do a much better job of ensuring the new administration understands the true value of their labors and the economics of drug development and its positive long-term impact on health care expenditures. If not, the biotech bears will not be hibernating anytime soon.