Analysis and data insight

BioWorld Infectious Disease Index (BIDI)

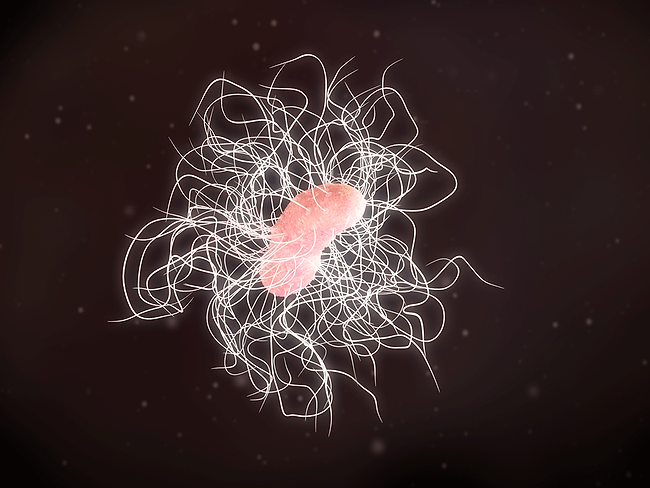

Acurx surges 250% as BIDI hits lowest point of the year

Read MoreMed-tech deals October 2023

Med-tech M&As continue decline while deal value soars nearly 50% YOY

Read MoreBiopharma financings October 2023