Peptide

Endocrine/metabolic

Newly identified signaling pathway affects both ends of energy balance

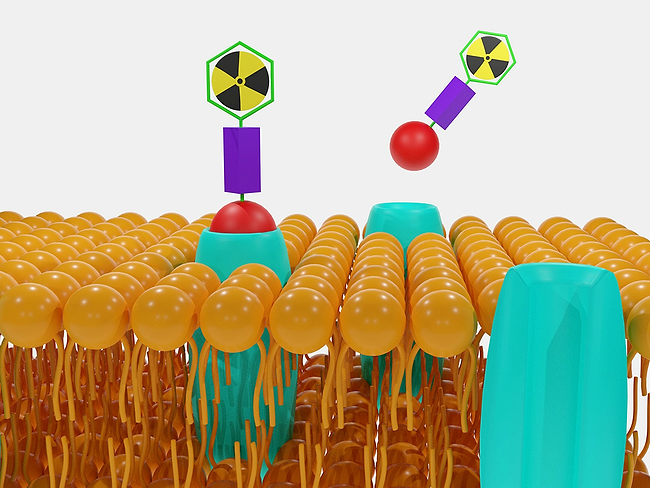

Read MoreDrug design, drug delivery & technologies

Aizen Therapeutics emerges from stealth to develop full D-amino acid therapeutics

Read MoreEndocrine/metabolic