IPO

Biopharma financings October 2024

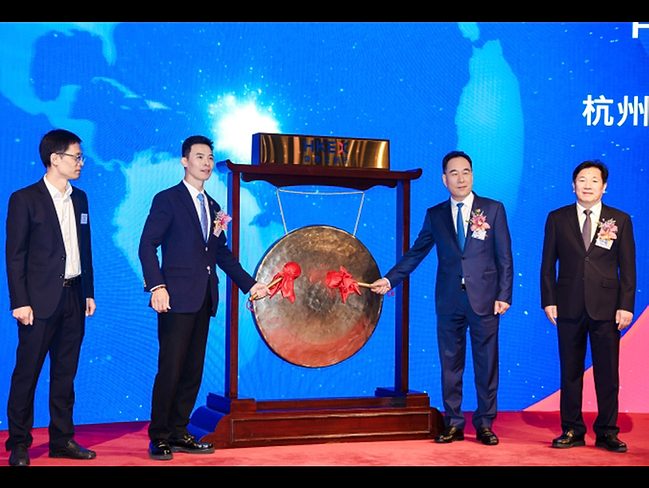

Biopharma IPOs raise nearly $1B in October from 5 public debuts

Read MoreBiopharma financings October 2024

Biopharma IPOs raise nearly $1B in October from 5 public debuts

Read MoreMed-tech financings October 2024