Articles by Amanda Lanier

Biopharma nonprofit deals and grants through 2024

Biopharma grants reach four-year high of $2.5B; nonprofit deals down

Read MoreBiopharma clinical updates July 2024

Roche’s Vabysmo success in phase III among July clinical updates

Read MoreBiopharma regulatory actions and approvals July 2024

July FDA approvals target Alzheimer's, myeloma and wet AMD

Read MoreBiopharma regulatory actions and approvals July 2024

July FDA approvals target Alzheimer's, myeloma and wet AMD

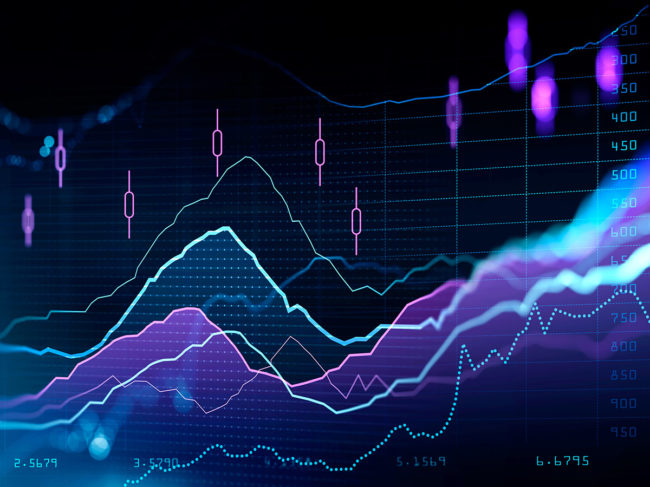

Read MoreBiopharma deals July 2024

GSK, Novartis lead July deals as biopharma sector sees more than $20B for the month

Read MoreBiopharma deals July 2024