- BioWorld

- BioWorld MedTech

- BioWorld Asia

- BioWorld Science

- Data Snapshots

- Special reports

- Infographics: Dynamic digital data analysis

- Trump administration impacts

- Biopharma M&A scorecard

- BioWorld 2024 review

- BioWorld MedTech 2024 review

- BioWorld Science 2024 review

- Women's health

- China's GLP-1 landscape

- PFA re-energizes afib market

- China CAR T

- Alzheimer's disease

- Israel

- Rise of obesity

- Radiopharmaceuticals

- Biosimilars

- Aging

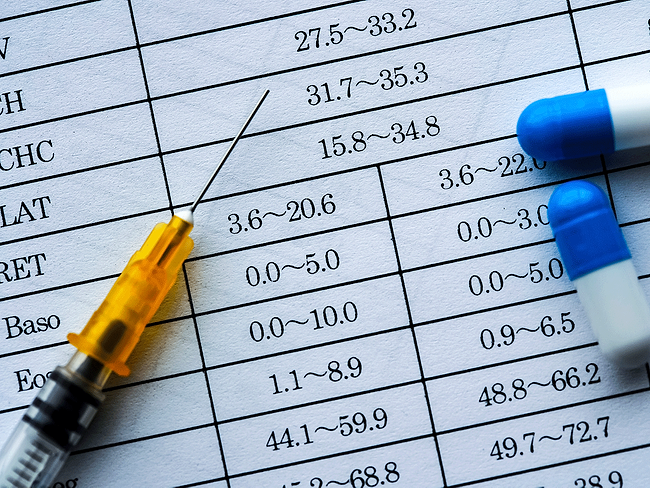

- IVDs on the rise

- Coronavirus

- Artificial intelligence

ARTICLES

Biopharma financings March 2025

Private biopharma financings jump to $2B in March, up from $1B

April 4, 2025

Biopharma clinical updates February 2025

February’s phase III wins include Qyuns’ ankylosing spondylitis data

April 1, 2025

Biopharma clinical updates February 2025

February’s phase III wins include Qyuns’ ankylosing spondylitis data

March 28, 2025

Biopharma regulatory actions and approvals February 2025

Global drug approvals hit 47 in February, surpassing 2024 monthly average

March 25, 2025

Biopharma regulatory actions and approvals February 2025

Global drug approvals hit 47 in February, surpassing 2024 monthly average

March 21, 2025

Biopharma deals February 2025

GSK’s $1.15B Idrx buyout leads slow M&A market as deals stay strong

March 18, 2025

- BioWorld

- BioWorld MedTech

- BioWorld Asia

- BioWorld Science

- Data Snapshots

- Special reports

- Infographics: Dynamic digital data analysis

- Trump administration impacts

- Biopharma M&A scorecard

- BioWorld 2024 review

- BioWorld MedTech 2024 review

- BioWorld Science 2024 review

- Women's health

- China's GLP-1 landscape

- PFA re-energizes afib market

- China CAR T

- Alzheimer's disease

- Israel

- Rise of obesity

- Radiopharmaceuticals

- Biosimilars

- Aging

- IVDs on the rise

- Coronavirus

- Artificial intelligence