- BioWorld

- BioWorld MedTech

- BioWorld Asia

- BioWorld Science

- Data Snapshots

- Special reports

- Infographics: Dynamic digital data analysis

- Trump administration impacts

- Biopharma M&A scorecard

- BioWorld 2024 review

- BioWorld MedTech 2024 review

- BioWorld Science 2024 review

- Women's health

- China's GLP-1 landscape

- PFA re-energizes afib market

- China CAR T

- Alzheimer's disease

- Israel

- Rise of obesity

- Radiopharmaceuticals

- Biosimilars

- Aging

- IVDs on the rise

- Coronavirus

- Artificial intelligence

ARTICLES

2023 Med Tech Conference

FDA’s Shuren says agency decidedly moving away from up-or-down vote at advisory hearings

Oct. 12, 2023

By Mark McCarty

2023 Med Tech Conference

EU’s notified body dilemma easing, but competent authorities continue to muddle the picture

Oct. 11, 2023

By Mark McCarty

2023 Med Tech Conference

PCCP concept at risk of being subsumed in debate over artificial intelligence

Oct. 10, 2023

By Mark McCarty

2023 Med Tech Conference

Advamed’s Whitaker more bullish on VALID Act in light of FDA draft rule for LDTs

Oct. 10, 2023

By Mark McCarty

2023 Med Tech Conference

Congress seen as having leeway to bring LDT user fees on board midstream in MDUFA VI

Oct. 9, 2023

By Mark McCarty

ASTRO 2023

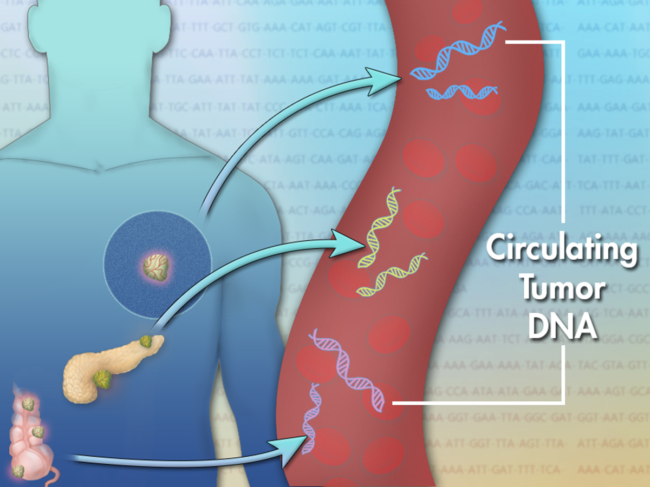

Study suggests that circulating tumor DNA is predictive of response to therapy in NSCLC

Oct. 4, 2023

By Mark McCarty

- BioWorld

- BioWorld MedTech

- BioWorld Asia

- BioWorld Science

- Data Snapshots

- Special reports

- Infographics: Dynamic digital data analysis

- Trump administration impacts

- Biopharma M&A scorecard

- BioWorld 2024 review

- BioWorld MedTech 2024 review

- BioWorld Science 2024 review

- Women's health

- China's GLP-1 landscape

- PFA re-energizes afib market

- China CAR T

- Alzheimer's disease

- Israel

- Rise of obesity

- Radiopharmaceuticals

- Biosimilars

- Aging

- IVDs on the rise

- Coronavirus

- Artificial intelligence