- BioWorld

- BioWorld MedTech

- BioWorld Asia

- BioWorld Science

- Data Snapshots

- Special reports

- Infographics: Dynamic digital data analysis

- Trump administration impacts

- Biopharma M&A scorecard

- BioWorld 2024 review

- BioWorld MedTech 2024 review

- BioWorld Science 2024 review

- Women's health

- China's GLP-1 landscape

- PFA re-energizes afib market

- China CAR T

- Alzheimer's disease

- Coronavirus

- More reports can be found here

ARTICLES

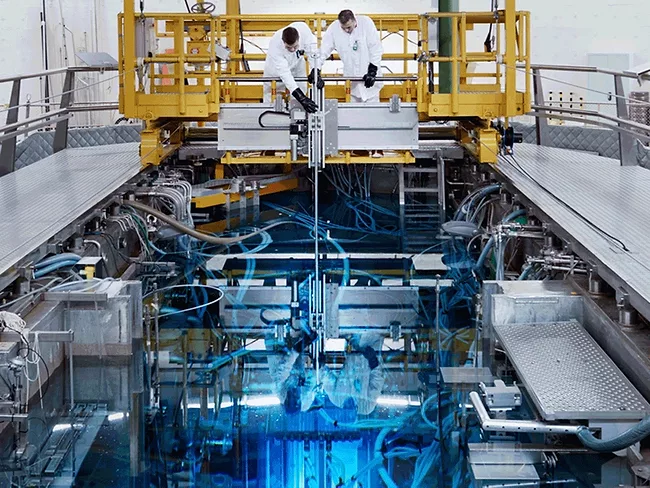

Radioactive revolution

Radiopharma pipeline gathers atomic speed

April 5, 2023

By Tamra Sami

Radioactive revolution

How equipped are radiopharma stakeholders to overcome radioactive challenges?

April 4, 2023

By Tamra Sami

Radioactive revolution

Radiopharmaceuticals on their way to becoming mainstream cancer therapies

April 4, 2023

By Tamra Sami

Radioactive revolution

How equipped are radiopharma stakeholders to overcome radioactive challenges?

April 3, 2023

By Tamra Sami

Radioactive revolution

Radiopharmaceuticals on their way to becoming mainstream cancer therapies

April 3, 2023

By Tamra Sami

- BioWorld

- BioWorld MedTech

- BioWorld Asia

- BioWorld Science

- Data Snapshots

- Special reports

- Infographics: Dynamic digital data analysis

- Trump administration impacts

- Biopharma M&A scorecard

- BioWorld 2024 review

- BioWorld MedTech 2024 review

- BioWorld Science 2024 review

- Women's health

- China's GLP-1 landscape

- PFA re-energizes afib market

- China CAR T

- Alzheimer's disease

- Coronavirus

- More reports can be found here