- BioWorld

- BioWorld MedTech

- BioWorld Asia

- BioWorld Science

- Data Snapshots

- Special reports

- Infographics: Dynamic digital data analysis

- Trump administration impacts

- Biopharma M&A scorecard

- BioWorld 2024 review

- BioWorld MedTech 2024 review

- BioWorld Science 2024 review

- Women's health

- China's GLP-1 landscape

- PFA re-energizes afib market

- China CAR T

- Alzheimer's disease

- Coronavirus

- More reports can be found here

ARTICLES

Anglonordic Life Science Conference

Denmark’s Cbio heads for clinic with TIL therapy

May 6, 2022

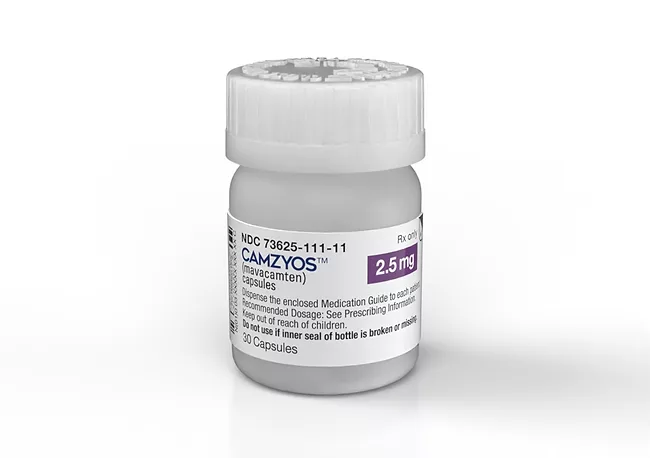

BMS wins FDA approval for chronic HCM drug mavacamten

April 29, 2022

By Lee Landenberger and Richard Staines

- BioWorld

- BioWorld MedTech

- BioWorld Asia

- BioWorld Science

- Data Snapshots

- Special reports

- Infographics: Dynamic digital data analysis

- Trump administration impacts

- Biopharma M&A scorecard

- BioWorld 2024 review

- BioWorld MedTech 2024 review

- BioWorld Science 2024 review

- Women's health

- China's GLP-1 landscape

- PFA re-energizes afib market

- China CAR T

- Alzheimer's disease

- Coronavirus

- More reports can be found here