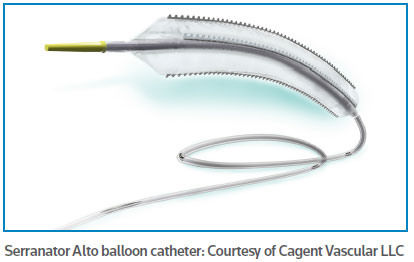

Cagent Vascular LLC. has received FDA clearance for its Serranator Alto PTA serration balloon catheter. The Wayne, Pa.-based company's device is the first of a family of peripheral artery disease (PAD) technologies under development which incorporate the company's serration technology in an angioplasty balloon.

The private company's device is indicated for dilatation of lesions in the iliac, femoral, iliofemoral and popliteal arteries and for the treatment of obstructive lesions of native or synthetic arteriovenous dialysis fistulae.

"The whole concept behind the Serranator Alto PTA device is to create these longitudinal lines of interrupted micro serration," Carol Burns, president and CEO of Cagent Vascular, told Medical Device Daily. Burns is also co-founder of Cagent Vascular.

Burns is no stranger to the vascular treatment space. She recently served as co-founder, president and CEO of Wayne, Pa-based, Intact Vascular Inc. and raised $17 million in capital to develop the Tack Endovascular System, a Nitinol implant in a multi-loaded catheter for treatment of PAD. Prior to Intact Vascular, she was the first employee of another peripheral vascular company, Embrella Cardiovascular.

Burns said Cagent Vascular's technology stands out because of its serration capabilities. This feature allows arterial expansion, she said.

"There are other types of technologies that have wires and strips on a balloon that are discontinuous," she said. "Our device grips the lesions by creating these little interrupted serrations."

Burns founded the company alongside its Chief Technology Officer and Vice President of Research and Development, Robert Giasolli, about two years ago. Since inception Cagent Vascular has raised about $7 million. Burns said the company would attempt to raise a series B round in the near future.

The company will eventually seek CE mark for the technology.

Cagent has also begun the development of the Serranator Bass for treatment of the below-the-knee or infrapopliteal arteries, where new technologies are desperately needed for the treatment of critical limb ischemia. Future applications of interest include serration technology for vessel preparation prior to the use of bioresorbable scaffolds in coronary arteries.

Burns said that she didn't foresee any adoption barriers and that the technology would be pretty straightforward for physicians and surgeons.

"What we're doing is something different and we believe there is going to be differentiation in how it works clinically, and we need to prove that out," Burns said. "Intuitively, I think when physicians see the concept of using serration technology, they get it."

VASCULAR DISEASE SPACE GROWING

There are about 200 million people worldwide who are living with PAD resulting in more than 700,000 interventional procedures in the U.S. and Europe each year, according to a study published in The Lancet in 2013. The disease affects about 3 percent to 7 percent of the entire population and up to one in five people over the age of 75.

The occurrences have created a strong market for companies like Cagent with a variety of different solutions set up to tackle vascular diseases.

The drug-coated balloon (DCB) space has seen the most movement in the treatment of PAD.

Medtronic plc, Spectranetics Corp. and C.R. Bard Inc. are all well established and have dominating positions in the DCB market. Bard's Lutonix 035 was the first to cross the U.S. finish line in the space in late 2014, followed closely by Medtronic's In.Pact Admiral.

Spectranetics entered the market when it acquired Covidien's Stellarx drug coated balloon for $30 million. (See Medical Device Daily, Nov. 4, 2014.) Covidien sold the assets to address antitrust law concerns going into its merger with Medtronic.