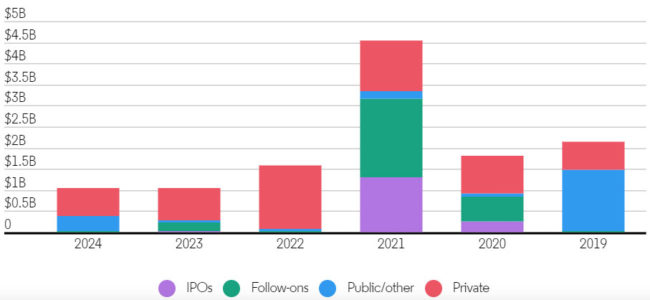

Acquisition

Med-tech deals 4Q23

Med-tech deals soar to record high in 2023, digital health still dominates

Read MoreMed-tech deals January 2024

January launches med-tech firms with $100M in deals, $1.43B in M&As

Read MoreMed-tech financings January 2024