Articles by Amanda Lanier

Bio Gainers and Losers 2023

2023 gainers and losers: Positive trial outcomes and M&As propel biopharma stocks to strong finish

Read MoreBio Gainers and Losers 2023

2023 gainers and losers: Positive trial outcomes and M&As propel biopharma stocks to strong finish

Read MoreBiopharma regulatory actions and approvals December 2023

2023 ends year with 191 US FDA approvals, including 55 NMEs

Read MoreMed-tech deals December 2023

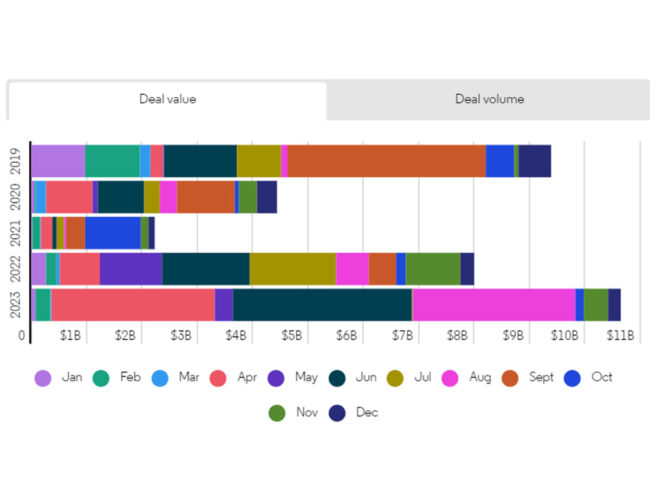

Med-tech deal value highest on record, climbs 33% YOY as M&As falter

Read MoreBiopharma deals December 2023

Biopharma shatters records as 2023 records the highest-ever deal value

Read MoreBiopharma financings 4Q23

Biopharma financings up in 2023 as value surpasses pre-pandemic levels

Read MoreBiopharma financings December 2023

Biopharma financings end 2023 up from last year, with $70.97B raised

Read MoreMed-tech financings December 2023