Articles by Amanda Lanier

BioWorld Biopharmaceutical Index (BBI)

Biopharma stocks again on the upswing after rollercoaster year

Read MoreBiopharma financings November 2023

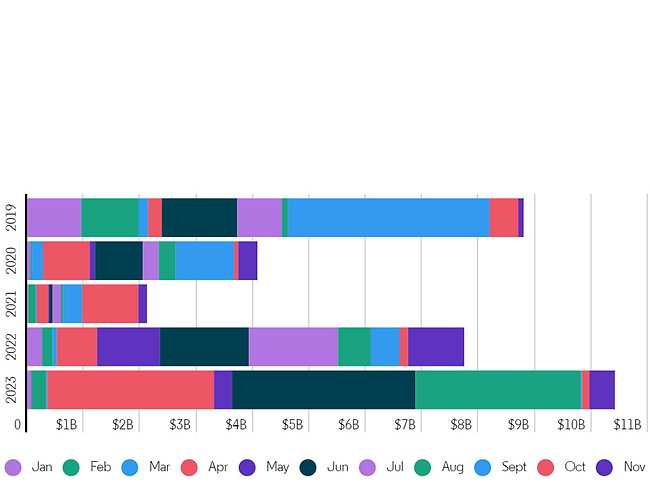

Biopharma funding hits $5.65B in November, with 18% increase YTD

Read MoreBiopharma financings November 2023

Biopharma funding hits $5.65B in November, with 18% increase YTD

Read MoreMed-tech financings November 2023

Med-tech financings mark YOY decline, November sees more than $1B raised

Read MoreBiopharma nonprofit deals and grants October 2023