- BioWorld

- BioWorld MedTech

- BioWorld Asia

- BioWorld Science

- Data Snapshots

- Special reports

- Infographics: Dynamic digital data analysis

- Trump administration impacts

- Biopharma M&A scorecard

- BioWorld 2024 review

- BioWorld MedTech 2024 review

- BioWorld Science 2024 review

- Women's health

- China's GLP-1 landscape

- PFA re-energizes afib market

- China CAR T

- Alzheimer's disease

- Israel

- Rise of obesity

- Radiopharmaceuticals

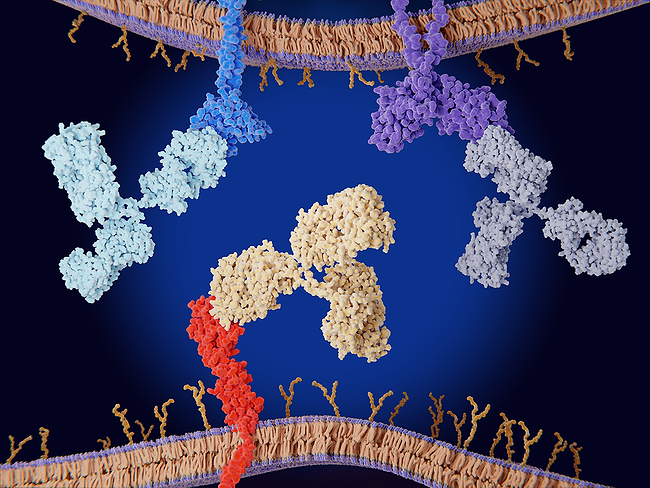

- Biosimilars

- Aging

- IVDs on the rise

- Coronavirus

- Artificial intelligence

ARTICLES

- BioWorld

- BioWorld MedTech

- BioWorld Asia

- BioWorld Science

- Data Snapshots

- Special reports

- Infographics: Dynamic digital data analysis

- Trump administration impacts

- Biopharma M&A scorecard

- BioWorld 2024 review

- BioWorld MedTech 2024 review

- BioWorld Science 2024 review

- Women's health

- China's GLP-1 landscape

- PFA re-energizes afib market

- China CAR T

- Alzheimer's disease

- Israel

- Rise of obesity

- Radiopharmaceuticals

- Biosimilars

- Aging

- IVDs on the rise

- Coronavirus

- Artificial intelligence